do you pay taxes on inheritance in north carolina

Under the North Carolina statutes if you are survived by. There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it.

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

These are some of the taxes you need to think about as an heir.

. These include Capital Gains income tax from retirement accounts and other like taxes. Your entire estate will pass to and be divided equally among your parents. If only one parent is still living then everything will pass to the living parent.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. The estate may be liable for federal estate taxNorth Carolina currently has no inheritance taxif the amount of the inheritance is above the estate tax threshold. If you inherit property in Kentucky for example that states inheritance tax will apply even if you live in a different state.

North Carolina does not collect an inheritance tax or an estate tax. However - there is no inheritance taxes on neither federal nor state level in North Carolina. Certain assets such as retirement accounts and life insurance policies may be subject to additional taxes.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. North Carolina Intestate Succession Laws. The recipient of an inheritance is not going to be paying transfer taxes on the inheritance unless there is an inheritance tax in the state within which the recipient resides.

An inheritance tax is a tax on the property you receive from the decedent. However there are sometimes taxes for other reasons. However if you inherit an estate worth over 1118 million in standard assets such as bank accounts you may be required to pay taxes federal estate tax.

There is no inheritance tax in North Carolina. There is no inheritance tax in North Carolina. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption.

Does North Carolina have an estate tax or inheritance tax. According to the new 10-year payout rule inherited IRAs that distribute large amounts of income each year may require heirs to pay. Fortunately if you live in North Carolina you dont have a state-level estate tax or inheritance tax to worry about.

An inheritance tax is not the same thing as an estate tax. North Carolina does not collect an inheritance tax or an estate tax. Its paid by the estate and not the heirs although it could reduce the value of their inheritance.

No estate tax or inheritance tax North carolina does not collect an inheritance tax or an estate tax. If you live in a state that does have an estate tax you may be expected to pay the death tax on the money you inherit from a death in NC. Ad From Fisher Investments 40 years managing money and helping thousands of families.

These tax issues vary a great deal based on state law and unique circumstances so if you have a tax issue or other legal issue contact King Law at 888-748- 5464 KING for a consultation. 2 An estate tax is a tax on the value of the decedents property. You may not have an.

Despite the inheritance tax repeal which gives north carolina residents the benefit of the full applicable credit amount for transfers at death north carolina has not fully unified its estate and gift tax system. Even though North Carolina has neither an estate tax or nor an inheritance tax the federal estate tax still applies to North Carolinians depending on the value of their estate. However sometimes there are taxes for other reasons.

There is no inheritance tax in NC. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received. We have offices located across western North Carolina and upstate.

No Inheritance Tax in NC. No spouse or children with parent s living. Currently states that have an inheritance tax include Iowa Kentucky Nebraska New Jersey Maryland and Pennsylvania.

The inheritance tax of another state may come into play for those living in North Carolina who inherit money. There is no federal inheritance tax. The recipient of an inheritance is not going to be paying transfer taxes on the inheritance unless there is an inheritance tax in the state within which the recipient resides.

There is no inheritance tax in North Carolina. The gains are included as income and taxed at the flat income tax rate of 525. The threshold for decedents.

However there are sometimes taxes for other reasons. If you die intestate each of your children receives an intestate share of your property. These are some of the taxes you may have to think about as an heir.

In North Carolina you are not required to pay state estate tax or inheritance tax. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1206 million. There is no capital gains tax in North Carolina.

Estate taxes are imposed on the total value of the estate - if the total estate value is large enough - the executor executor of the estate must file federal and a North Carolina estate tax returns and pay any tax due within 9 months after the death. However there are sometimes taxes for other reasons. North carolina does not have estate or inheritance taxes.

No Inheritance Tax in NC. The amount of money you will pay tax on is determined by the difference. Only six states have an inheritance tax though Kentucky is one of them.

Click to see full answer. Currently the estate tax threshold is 1118 million for an individual and double that for a couple.

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

North Carolina Retirement Tax Friendliness Smartasset

North Carolina Health Legal And End Of Life Resources Everplans

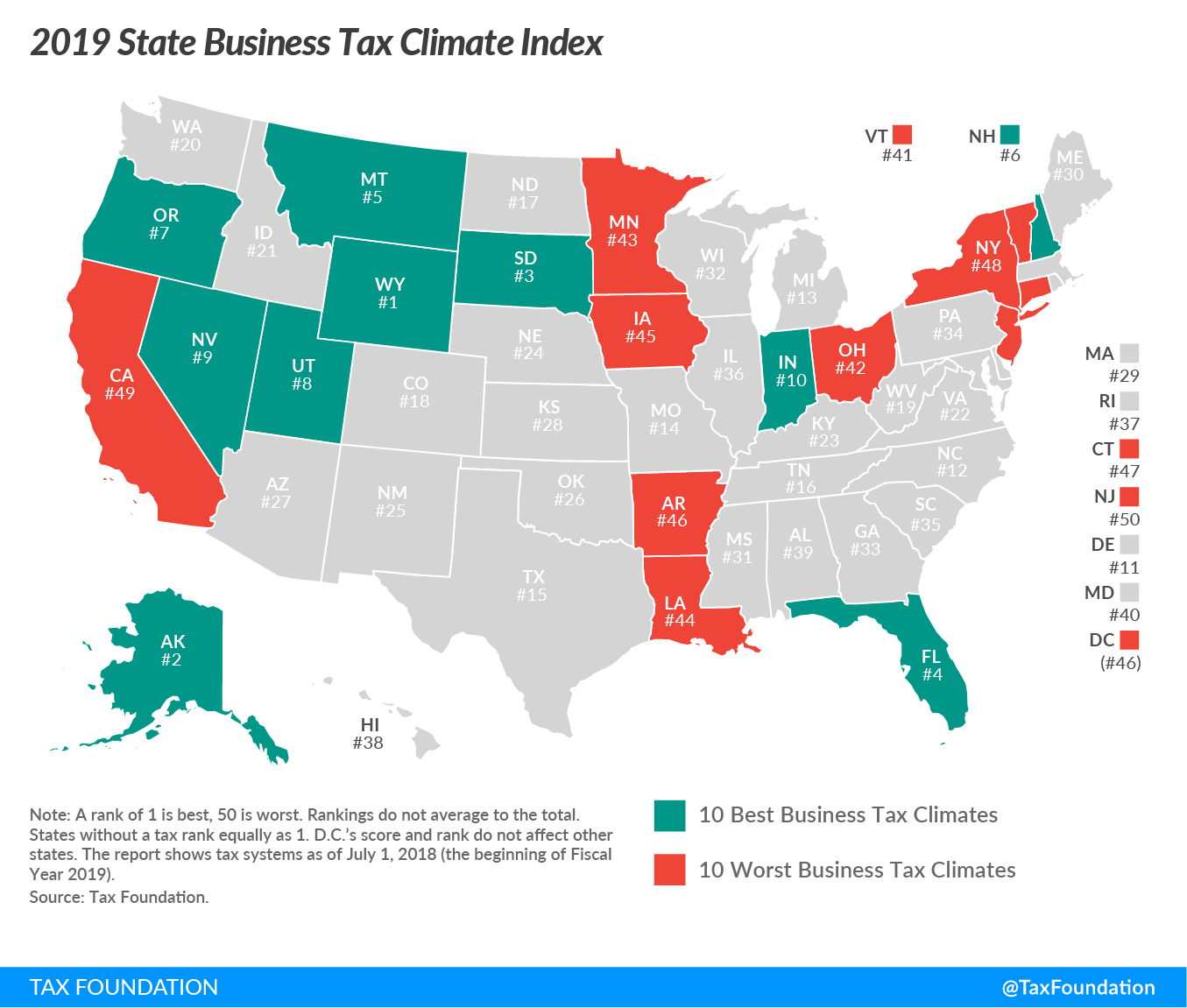

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

North Carolina State Taxes Everything You Need To Know Gobankingrates

Probate Fees In North Carolina Updated 2021 Trust Will

How To Inherit Retirement Assets In North Carolina

North Carolina State Taxes 2022 Tax Season Forbes Advisor

187 Front Page 1 30 Normalize North Carolina Court System

North Carolina Last Will And Testament Template Download Printable Pdf Templateroller

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Historical North Carolina Tax Policy Information Ballotpedia

What Happens If I Die Without A Will Intestate In Nc Carolina Family Estate Planning

The Cost Of Living In North Carolina Smartasset Living In North Carolina Cost Of Living North Carolina

North Carolina Taxation Familysearch

A Guide To North Carolina Inheritance Laws

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina